Sênachê Consulting

For the ultimate benefit of society

Accuracy, Flexibility, Excellence

What we do

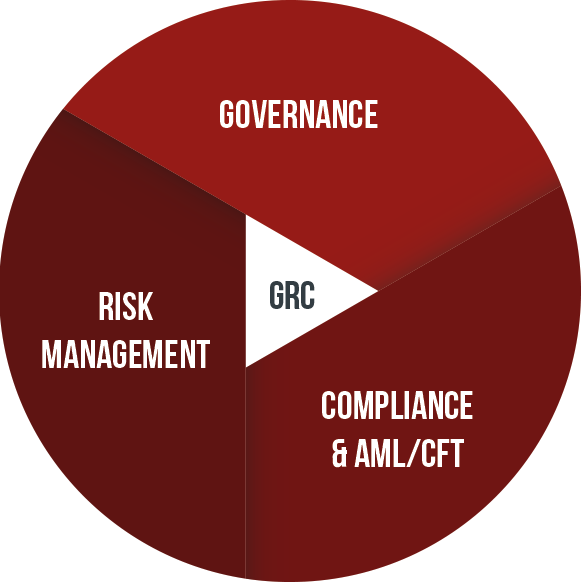

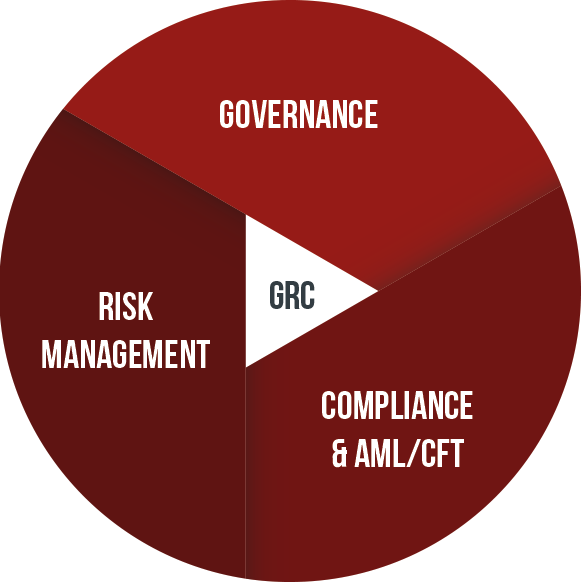

GRC : our three functions for serving Asset Managers

We assist you facing current and futures challenges

Governance

We thrive for Value creation and avoid value destruction. Within the Collective knowledge of the Board, we oversee the authorised management and the framework by which Investments Funds and/or IFMs are directed and controlled.

What we offer

- Independent Non-Executive Director mandates for regulated and non-regulated Investment Funds and Investment Fund Managers.

Risk Management

For both liquid and illiquid strategies, we Identify, Measure, Manage, Monitor and Report the financial (market, credit, counterparty, liquidity) and non financial (operational, sustainability (incl. physical and transition)) risks.

What we offer

- Risk Management operational support for both liquid and illiquid strategies;

- Risk Management function mandate;

- Risk Conducting Officer mandate.

Compliance & AML/CFT

For ensuring compliance to the regulatory requirements and to the statutory requirements of our clients, we anticipate, identify, assess and mitigate the compliance & AML/CFT risks (reputational, legal, dispute, sanctions, operational).

What we offer

- RC mandate;

- Compliance Officer operational support;

- Compliance Officer mandate;

- Compliance Conducting Officer mandate.

Considering the lack of talent and the ever-changing regulatory landscape, we leverage our expertise in Governance, Risk Management and Compliance & AML/CFT to ensure the robustness of Investment Fund Managers.

What we do

GRC : our three functions for serving Asset Managers

We assist you facing current and futures challenges

Governance

We thrive for Value creation and avoid value destruction. Within the Collective knowledge of the Board, we oversee the authorised management and the framework by which Investments Funds and/or IFMs are directed and controlled.

What we offer

- Independent Non-Executive Director mandates for regulated and non-regulated Investment Funds and Investment Fund Managers.

Risk Management

For both liquid and illiquid strategies, we Identify, Measure, Manage, Monitor and Report the financial (market, credit, counterparty, liquidity) and non financial (operational, sustainability (incl. physical and transition)) risks.

What we offer

- Risk Management operational support for both liquid and illiquid strategies;

- Risk Management function mandate;

- Risk Conducting Officer mandate.

Compliance & AML/CFT

For ensuring compliance to the regulatory requirements and to the statutory requirements of our clients, we anticipate, identify, assess and mitigate the compliance & AML/CFT risks (reputational, legal, dispute, sanctions, operational).

What we offer

- RC mandate;

- Compliance Officer operational support;

- Compliance Officer mandate;

- Compliance Conducting Officer mandate.

Considering the lack of talent and the ever-changing regulatory landscape, we leverage our expertise in Governance, Risk Management and Compliance & AML/CFT to ensure the robustness of Investment Fund Managers.

Collaborate is also contributing to others

In Luxembourg

In Luxembourg, 1% of the total invoiced amount for a collaboration between us will be granted to a Luxembourgish association of your choice among the 5 aforementioned associations we are supporting. This will allow us to contribute together to our society while we are assisting you at the same time

In France

In France, 1% of the total invoiced amount for a collaboration between us will be granted to a French association of your choice among the 5 aforementioned associations we are supporting. This will allow us to contribute together to our society while we are assisting you at the same time.

Collaborate is also contributing to others

In Luxembourg

In Luxembourg, 1% of the total invoiced amount for a collaboration between us will be granted to a Luxembourgish association of your choice among the 5 aforementioned associations we are supporting. This will allow us to contribute together to our society while we are assisting you at the same time

In France

In France, 1% of the total invoiced amount for a collaboration between us will be granted to a French association of your choice among the 5 aforementioned associations we are supporting. This will allow us to contribute together to our society while we are assisting you at the same time.

Our founder

Daniel Cakpo-Tozo, FRM, GFR, RC

Advisor | Independent Non-Executive Director

Daniel is a Trusted Advisor with 10+ years of experience in Fund Governance, Risk Management and Compliance & AML/CFT.

In 2021, he has founded Sênachê Consulting that delivers Operational team support assignments and take RC, Conducting Officer, and/or Independent Non-Executive Director mandates for assisting IFMs (AIFM, UCITS, Super ManCo, ManCo+) and the UCITS and Alternative Investment Funds (SCSp/SCS, RAIF, SIF, SICAR, Part II UCI, EuVECA, EuSEF, ELTIF) they manage.

Before launching Sênachê Consulting, Daniel worked, inter alia, as Manager at KPMG Luxembourg where he delivered Interim Conducting Officers assignments and a range of Asset Management regulatory consulting assignments (AIFM licence extension, oversight framework set-ups, etc.).

Prior to that, Daniel was a Senior Consultant at PwC Luxembourg where he drafted and reviewed Risk Management Processes & Policies for both UCITS and AIFMs, delivered independent review of VaR models assignments for UCITS, ensure AIFMD reporting for a wide range of authorised AIFMs and give trainings on Market Abuse Directive and Market Abuse Regulation (MAD, MAR & CSMAD).

Daniel holds both a Master in Risk Management and a Research Master in Economics and he has obtained different certifications in (i.) Governance (Fund Governance Diploma, Certified ILA Bootcamp on Luxembourg Corporate Governance), in (ii.) Risk Management (FRM, GFR), and in (iii.) Compliance & AML/CFT (RC, M1 & M2, AML).

Our founder

Daniel Cakpo-Tozo, FRM, GFR, RC

Advisor | Independent Non-Executive Director

Daniel is a Trusted Advisor with 10+ years of experience in Fund Governance, Risk Management and Compliance & AML/CFT.

In 2021, he has founded Sênachê Consulting that delivers Operational team support assignments and take RC, Conducting Officer, and/or Independent Non-Executive Director mandates for assisting IFMs (AIFM, UCITS, Super ManCo, ManCo+) and the UCITS and Alternative Investment Funds (SCSp/SCS, RAIF, SIF, SICAR, Part II UCI, EuVECA, EuSEF, ELTIF) they manage.

Before launching Sênachê Consulting, Daniel worked, inter alia, as Manager at KPMG Luxembourg where he delivered Interim Conducting Officers assignments and a range of Asset Management regulatory consulting assignments (AIFM licence extension, oversight framework set-ups, etc.).

Prior to that, Daniel was a Senior Consultant at PwC Luxembourg where he drafted and reviewed Risk Management Processes & Policies for both UCITS and AIFMs, delivered independent review of VaR models assignments for UCITS, ensure AIFMD reporting for a wide range of authorised AIFMs and give trainings on Market Abuse Directive and Market Abuse Regulation (MAD, MAR & CSMAD).

Daniel holds both a Master in Risk Management and a Research Master in Economics and he has obtained different certifications in (i.) Governance (Fund Governance Diploma, Certified ILA Bootcamp on Luxembourg Corporate Governance), in (ii.) Risk Management (FRM, GFR), and in (iii.) Compliance & AML/CFT (RC, M1 & M2, AML).